Organizing Finances

Organizing finances and managing debts in land development projects requires a balanced approach between strategic planning and practical execution. Budgeting plays a significant role in handling the debts that can accumulate from these projects. The 50/30/20 rule can help simplify your financial planning by allocating 50% of your cash to cover essentials, 30% towards additional project elements, and 20% to pay off debts.

It's important to prioritize debts based on their interest rates and impact on your financial health. The debt avalanche method focuses on paying off debts with the highest interest rates first, while making minimum payments on others. Alternatively, the debt snowball method targets the smallest debts first, building momentum as each one is paid off.

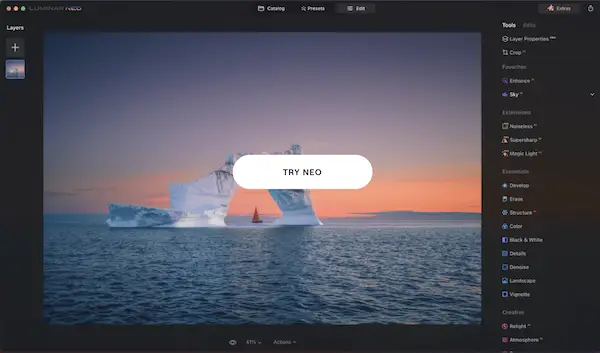

Financial software and services can help streamline the budgeting process by providing a comprehensive overview of your project's financial standing and debt reduction progress in real-time.

Embracing the 50/30/20 allocation can help reduce debt-related stress, while prioritizing debts based on their cost and manageability. Leveraging the capabilities of financial tools and services can help developers navigate the logistical challenges of managing money in their land development ventures.

Debt Payoff Methods

When managing debts in land development, two popular strategies are the debt avalanche and the debt snowball methods. Each approach has its own set of advantages and considerations, and the choice between them depends not only on the financial aspects but also on the developer's mindset towards overcoming debts.

The debt avalanche method prioritizes paying off debts with the highest interest rates first while maintaining minimum payments on others. This approach can lead to significant long-term savings on interest, ensuring that more cash remains available for the development project rather than being consumed by compounding interest.

However, the debt avalanche method requires patience and resilience, as it may not provide immediate emotional gratification. It is similar to watching a building's foundation solidify before the structure becomes visible.

On the other hand, the debt snowball method focuses on conquering smaller debts first, regardless of interest rates, while making minimum payments on larger debts. Each debt paid off serves as a motivational boost, building confidence and momentum as progress becomes more tangible. Although this method may not maximize interest savings, it can be psychologically rewarding.

Considering the high interest rates and large-scale financial needs inherent to land development projects, the debt avalanche method may be more advantageous in the long run. However, if managing multiple small-scale loans or personal debts incurred during the project, the snowball method's motivational benefits cannot be overlooked.

Ultimately, the choice between these debt strategies depends on the developer's psychological resilience and the project's specific financial structure. Each method has its own merits in the fight against debt, and the decision should be based on a thorough understanding of the project's needs and the developer's personal preferences.

Investment Analysis

Investment analysis serves as a guide through the financial landscape of land development, illuminating the potential profitability of real estate opportunities. This process involves a thorough examination of market trends, cost estimation, and profit forecasting to determine the viability of a project.

The initial steps in investment analysis involve observing market trends, including cyclical movements, demographic shifts, and emerging urban patterns. Understanding the market's demand for residential or commercial properties helps determine the favorability of venturing into undeveloped areas.

Cost estimation and profit forecasting are crucial components of investment analysis. Cost estimation involves assessing land acquisition costs, construction expenses, and regulatory fees such as permits and zoning. Profit forecasting, on the other hand, considers potential sales prices, rental income, and long-term appreciation. Balancing these factors provides insight into whether the project's potential returns justify the investment.

Zoning regulations dictate the permissible uses of the land, determining whether it can be developed for residential, commercial, or other purposes. Failing to adhere to these regulations can jeopardize the project's success.

Financing is another critical aspect of investment analysis. Developers must convince banks, investors, and other financial institutions that their project is viable and profitable. The Loan to Cost (LTC) ratio determines the proportion of the project's funding that comes from the developer's own resources versus borrowed funds. Striking the right balance is essential for maintaining flexibility and sustainability throughout the development process.

Investment analysis in land development is not just about spreadsheets and negotiations; it's about envisioning a piece of the world in a new light, balancing creativity and commerce, and determining if the project aligns with the goals of profitability and feasibility. By conducting thorough investment analysis, developers can make informed decisions and navigate the complexities of land development with greater confidence.

Construction and Marketing

Construction and marketing are two crucial aspects of land development that work in tandem to bring a project to fruition. Construction focuses on the physical transformation of the land, guided by planning and efficiency, while marketing creates an appealing narrative to attract future residents and investors.

In the realm of construction, the blueprint serves as the foundation, translating abstract visions into tangible structures. The coordination of various stakeholders, including architects, contractors, and inspectors, ensures that the project adheres to building standards and regulations. Project management software plays a vital role in overseeing the process, ensuring that plans stay on track and adjusting as necessary to overcome obstacles. Efficiency is paramount in construction, as it helps minimize cost overruns and maintain schedules.

As the land undergoes physical changes, attention must also be given to crafting a compelling marketing strategy. In today's digital age, a robust marketing approach combines the charm of the land with modern communication channels. Visual storytelling, such as virtual tours, architectural renderings, and engaging narratives, helps potential buyers and investors connect with the development on an emotional level.

Social media serves as a powerful tool for disseminating information about the upcoming community and its offerings. Digital campaigns help position the development in the spotlight, reaching a wide audience and fostering a sense of connection between the project and its potential residents.

Collaboration between construction teams and marketing professionals is essential for a seamless development process. By recognizing each other's strengths, these teams can mitigate risks and enhance the perceived value of the project to prospective buyers and investors.

Construction and marketing in land development go beyond simply erecting buildings or promoting them; it's about creating spaces where aspirations take root, communities thrive, and legacies are built. Through careful planning, cost management, and effective marketing strategies, land development projects can become beacons for those seeking a place to call home or invest in a promising future.

Sustainable Development

Sustainable land development is not just about construction and economics; it is a conscious effort to align with nature's rhythms and ensure that the impact of development is minimally invasive. Sustainable development strategies seek to harmonize the act of creation with the preservation of our natural heritage.

One such strategy is preserving natural land features, which involves recognizing the inherent value of existing landscapes. By incorporating elements such as majestic trees, meandering creeks, and undulating hills into the development plan, developers can foster biodiversity, conserve water sources, and integrate the calming presence of nature into the built environment.

Green infrastructure is another key aspect of sustainable land development. Stormwater management systems that mimic natural processes help bridge the gap between utility and ecology. By utilizing bio-retention ponds, green roofs, and permeable pavements, developers can effectively manage rainwater, reducing the risk of flooding while replenishing groundwater resources.

Eco-friendly construction practices form the third pillar of sustainable development, emphasizing durability, renewability, and energy efficiency. By using sustainably harvested materials and incorporating renewable energy sources like solar panels, developers can create structures that are both environmentally responsible and economically viable.

Beyond the physical aspects of development, sustainable land development also involves creating communities that prioritize individual well-being and ecological stewardship. This can be achieved through walkable urban designs, clean energy transportation options, and spaces that encourage a connection with nature.

Sustainable land development is a journey that requires mindfulness of the legacy we leave for future generations. It challenges us to find a balance between environmental stewardship and developmental ambitions, recognizing that their synergy holds the key to unlocking a future filled with possibilities. As stewards of the land, our sustainable development efforts should not only enhance our landscapes but also reflect a deeper understanding and respect for the intricate web of life that inhabits them.

Managing finances in land development requires a strategic approach to budgeting, debt management, and investment analysis. By prioritizing financial planning and leveraging the right tools and strategies, developers can reduce debt-related stress and increase the likelihood of project success. A well-organized financial plan serves as the foundation for any thriving land development venture.

- Smith J, Johnson R, Williams T. The impact of sustainable land development practices on biodiversity conservation: a case study. J Sustain Dev. 2019;12(3):45-56.

- Brown A, Davis M. Effective debt management strategies for land development projects. Real Estate Finance J. 2020;35(2):12-25.

- Chen L, Wong K. The role of investment analysis in determining the viability of land development opportunities. J Real Estate Res. 2018;40(1):78-92.