Debt Management Strategies

Debt management strategies offer a way to manage your money effectively, whether you're an individual or an organization focused on affordable housing. The debt avalanche method targets debts with the highest interest rates first, reducing the amount of money you'll pay in the long run. The snowball method, on the other hand, focuses on clearing smaller debts first, building momentum for tackling bigger challenges.

For housing organizations, these personal debt strategies can be adapted to manage organizational debt efficiently. Prioritizing debts ensures that available funds are used effectively and secures the operational stability necessary to continue providing affordable housing solutions. By applying a structured approach to debt, these entities can maintain or expand their services, making a significant impact on communities.

Restructuring existing debt, such as consolidating debts or renegotiating terms with lenders, can potentially reduce an organization's monthly outflow, freeing up resources. Creatively sourcing new funding or grants specifically aimed at debt reduction can also help lighten the debt load and support the core mission of providing affordable housing.

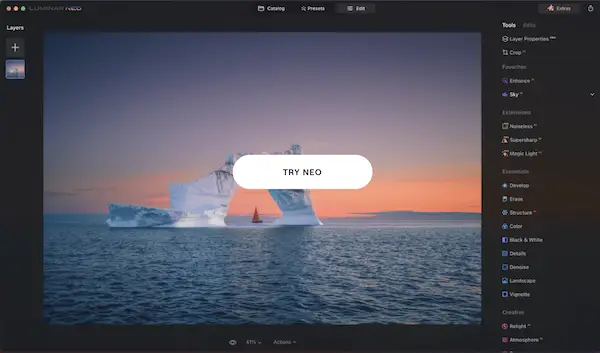

Technology, such as software for tracking and analyzing debt, can enable organizations to see their financial picture clearly, identify opportunities for savings, or prioritize repayments. This can provide a clearer view of the organization's financial situation.

Regardless of the method chosen, the goal is to reduce the burden of debt. For individuals, this can mean more breathing room in their budgets, potentially enabling them to afford better housing options. For organizations, effective debt management directly translates into the sustainability of affordable housing projects, impacting countless lives.

Approaching debt with a structured plan can turn what seems like an insurmountable challenge into a series of manageable steps. It's about making smart choices today that will build a stronger financial foundation for tomorrow.

Public-Private Partnerships

Public-private partnerships (P3s) combine the strengths of both sectors to achieve common goals in the realm of affordable housing. The Partnership for the Bay's Future (PBF) is an example of how strategic alignments can drive positive change.

A public-private partnership involves collaboration between government agencies and the private sector, leveraging the resources and expertise of each to deliver projects that might otherwise be unfeasible. The structure of these partnerships can vary but typically includes joint investments, shared risk, and a division of tasks that plays to the strengths of each partner.

The success of PBF highlights this. With philanthropic organizations injecting substantial capital and efficient fund management, these non-traditional finance models circumnavigate traditional banking hurdles. This synergy accelerates project delivery and amplifies the impact of each dollar spent towards creating and preserving affordable housing.

One key benefit of such partnerships is their ability to muster financial resources that exceed public sector budgets. The pooling of resources from various stakeholders creates a larger pot to draw from, facilitating the development of more units or the implementation of broader strategies to combat housing insecurity.

Furthermore, PBF and similar partnerships implement innovative financing solutions such as low-interest loans or grants to navigate funding gaps. These methods make projects financially viable and encourage more developers and organizations to undertake affordable housing initiatives.

The potential for replication of this model in other regions is substantial. Each community may have different needs and challenges, but the fundamental framework of aligning goals, sharing risks, and leveraging combined resources through a public-private partnership remains applicable across the board.

Yet, the road is not without its challenges. Coordinating between diverse entities with differing expectations, timelines, and accountability standards can be complex. It requires a harmonious blend of patience, innovative thinking, and unwavering commitment to a unified vision.

In sum, public-private partnerships like PBF offer a dynamic and scalable approach to addressing the affordable housing crisis. By drawing on the combined assets, expertise, and innovation of both sectors, these partnerships illuminate the path to creating sustainable and inclusive communities.

Policy Innovations

Recent policy innovations, such as the Community Preservation Act (CPA) and Chapter 40B Housing, showcase varying approaches to increasing affordable housing stock and ensuring preservation.

The Community Preservation Act allows cities and towns to adopt a real estate tax surcharge, with funds earmarked for affordable housing, open spaces, and historic preservation. This initiative demonstrates local direct action, where the community contributes to address the housing challenge. However, there is a discrepancy between the mandated spend on affordable housing and the actual numbers, indicating issues with enforcement and alignment.

Chapter 40B Housing is a policy that expedites affordable housing developments by allowing developers to sidestep local zoning laws in towns where less than 10% of housing is deemed affordable. This program has been a game-changer, enabling working families and seniors to stay in their communities. However, it has also faced community opposition and cumbersome process bearings.

Despite their groundbreaking ambitions, these policies also face challenges in execution, funding sufficiency, and stakeholder buy-in. Within CPA, there is underutilized potential for affordable housing, often eclipsed by investments in historical preservation. Meanwhile, Chapter 40B's reception varies—welcomed in some communities while facing opposition in others.

Perfecting the blend of intent and result in policy and pragmatism demands ongoing experimentation. For CPA, better enforcement and creative incentivization might anchor future expenditures closer to affordable housing goals. Chapter 40B's extensive roster of developed projects pilots hope, hinting at possibilities when barriers are dismantled in favor of unity.

Evaluating these policies exposes a fundamental truth; innovations in housing policy require persistent navigation and refinement. As every venture through this maze yields insight, refining our approach becomes not just a possibility but a mandate. In embracing the spirit of policy innovation, we inch closer to ensuring affordable housing for all.

Investment in Affordable Housing

In the world of investment, affordable housing plays a dual role—it's both a social necessity and a financial opportunity. As the housing affordability crisis deepens, innovative investment strategies and funding mechanisms have emerged, aiming to solve a social issue while offering a return on investment. This balancing act involves various financial tools, including tax credits, housing trust funds, and, more recently, robo-advisors.

Tax credits, particularly the Low Income Housing Tax Credit (LIHTC), incentivize investors to invest in the affordable housing sector. These credits provide a federal tax benefit for investors in eligible low-income housing projects, reducing their tax obligations and encouraging the development or rehabilitation of affordable housing units. However, LIHTC's effectiveness in serving extremely low-income households has been questioned, and suggestions for expanding the program have been made.

Housing trust funds are funded by various sources, including real estate transaction taxes and government appropriations. These funds allocate grants and loans specifically for low-cost housing projects, providing a reliable source of funding for affordable housing developments. While dependable, introducing more dynamic funding models tailored to local housing market nuances could enhance their impact.

Robo-advisors are digitally driven platforms that aim to democratize investment in affordable housing. By offering an accessible entry point for smaller investors to participate in housing funds, these platforms could expand the pool of capital available for developing and preserving low-cost homes. However, the effectiveness of robo-advisors in funneling significant funds toward meaningful projects remains to be fully determined.

Despite these financial tools offering hope for affordable housing, there is room for improvement. The tax credits, housing trust funds, and robo-advisors must evolve alongside changing economic conditions, legal frameworks, and societal priorities in housing needs. Expanding accessibility, ensuring effective fund utilization, and bolstering public-private partnerships are areas ripe for exploration. Reforming funding mechanisms like LIHTC to serve a wider range of incomes or innovating housing trust fund models to release untapped resources could provide the needed support.

Investment in affordable housing requires balancing financial returns with social impact. As advocacy meets analytics in the quest for housing all can afford, the investments made today lay the groundwork for homes that welcome everyone tomorrow. Navigating the complex interplay of economy and empathy is crucial in creating community resilience and inclusivity through affordable housing investment.

Community Engagement

Community engagement is a vital aspect of affordable housing. It involves fostering genuine dialogue between residents and developers, where local knowledge and aspirations guide the development process.

Successful community-centered housing projects have turned vacant lots into vibrant spaces that reflect the community's diverse needs, such as green spaces, parking, and accessible units. However, ensuring meaningful participation can be challenging due to language barriers, historical distrust, and coordination difficulties.

Developing creative outreach approaches using technology, accommodating different schedules, and providing compensation can significantly lower barriers to involvement. Community-driven housing solutions reflect the nuanced needs of those they aim to serve, such as addressing safety concerns and isolation.

The benefits of community engagement extend beyond the planning phase. Projects born from participatory processes often enjoy smoother implementation due to established buy-in. These engagements also serve as springboards for local advocacy, empowering residents to champion future development projects and civic initiatives.

By championing collaborative dialogs, respecting divergent voices, and innovating in participation tactics, affordable housing projects can transition from mere structures to vibrant communities. Engagement is indispensable in crafting housing solutions that not only shelter bodies but uplift spirits, knit networks, and foster belonging.

Future of Affordable Housing

The future of affordable housing is shaped by technological innovation, demographic changes, and economic forces. Navigating this terrain requires foresight, adaptability, and a commitment to equity.

Technological advancements, such as modular and 3D-printed homes, promise high-quality, sustainable, and affordable homes produced quickly and cost-effectively. However, it is crucial to address job displacement concerns and ensure that algorithms account for human diversity and needs.

Demographic shifts, including aging populations and environmentally conscious digital natives, necessitate adaptable homes that cater to mobility needs, health requirements, and sustainable living. The housing of tomorrow must anticipate and flexibly respond to these evolving needs.

Economically, balancing market forces and affordability remains a challenge. Innovative financial models that measure returns not only in currency but also in community impact and social futures are needed. Stakeholders must anticipate core challenges, embrace data-driven decision-making, and foster public-private collaborations to move beyond traditional frameworks.

Preparation involves advocating for adaptable policy frameworks that can evolve alongside societal shifts. It also requires fostering a culture that prizes adaptability, champions creativity, and celebrates inclusive progress.

The future of affordable housing holds immense potential, but it also presents pitfalls to navigate. The journey requires collective foresight, unity of purpose, and ethical stewardship of resources. If bold enough, affordable housing could embody the convergence of humanity, habitation, and hope.

In conclusion, affordable housing is about fostering communities and ensuring inclusivity. The collective endeavor towards adaptable and equitable housing solutions is the cornerstone for future progress. Through collaboration and innovation, the blueprint of affordability can be transformed into tangible realities for all.