The commercial real estate sector stands at a crossroads, influenced by a variety of factors including market trends, technological advancements, and regulatory changes. This landscape is continuously shaped by the dynamic interplay between these elements, presenting both challenges and opportunities for stakeholders.

Market Trends

Market trends significantly shape the commercial real estate landscape, with different sectors reacting uniquely to current economic conditions. One observable trend is the fluctuating demand for office spaces. As remote work becomes more common, traditional office spaces face challenges, creating opportunities for properties that can adapt to new work models by offering flexible or co-working environments.

In the industrial sector, e-commerce growth fuels demand for warehouses and distribution centers. Online shopping means companies are seeking spaces that can accommodate quick shipping, especially in strategic locations that allow for efficient two-day delivery to a large portion of the population. Industrial real assets in areas like Nashville, identified for its central location, are becoming attractive for investors.

Retail spaces experience a mixed bag. While Class B and C malls struggle to attract foot traffic, neighborhood shopping centers in densely populated areas hold their ground. This resilience is partly because e-commerce, despite its rapid growth, accounts for just 15% of all retail sales1. There's potential for retail spaces that can adapt and serve their local communities effectively.

The multifamily sector remains robust, driven by high demand for housing. Economic factors such as rising interest rates make home buying less accessible, pushing more people towards renting. This sustained demand keeps vacancy rates low, making multifamily properties a stable choice for investors. However, luxury apartments present a cautionary tale, with some markets seeing slowed demand, signaling investors to be discerning about where they allocate their resources.

Global capital trends show a shift towards industrial and multifamily assets amid overall real estate investment slowdown. This movement reflects a broader search for stable returns in uncertain times and highlights the adaptive nature of investment capital seeking out opportunities in sectors with strong fundamentals.

Rental rates in specialized sectors like data centers surge owing to the high demand for data storage and processing capabilities. Innovations in AI and other technologies underscore the critical need for enhanced data infrastructure, leading to spikes in rental rates across key markets.

Lending activity hints at cautious optimism, with slight upticks signaling the financial market's recalibrating stance toward real estate. Amid these contours of change, commercial real estate professionals scan the horizon, leveraging insights and strategic foresight to navigate the market's shifting sands.

While challenges such as interest rate fluctuations and rising operational costs persist, strategic opportunities await nimble investors and developers. Whether it's cash optimization strategies in a fluctuating market, investing in energy-efficient upgrades, or exploring proptech for competitive advantage, current market trends underscore the importance of agility and informed decision-making in commercial real estate endeavors.

As sectors like industrial and multifamily chart promising courses, the office and retail landscapes continue their evolution, stimulated by shifts in work habits and consumer behavior. Proptech advancements and sustainable improvements stand out as beacons of progress, guiding the commercial real estate sector toward a resilient and dynamic future.

Interest Rates

Interest Rate Fluctuations and Commercial Real Estate

The relationship between interest rates and commercial real estate is complex, with each change affecting value, investor behavior, and financing mechanisms. Recent trends and anticipated movements in interest rates significantly influence the sector's dynamics, presenting a mix of challenges and opportunities for investors and developers.

Interest rates directly impact the cost of borrowing. When rates rise, financing or refinancing properties becomes more expensive. This can dampen investor enthusiasm, as higher costs reduce potential returns. Conversely, lower interest rates make borrowing cheaper, potentially spurring investments as the cost of capital decreases. The direct relationship between interest rate movements and financing accessibility underscores the pivotal role rate changes play in investment decisions.

Property values also correlate with interest rates. A rise in rates can lead to a decline in property values as investors demand higher yields, which puts downward pressure on prices. Conversely, declining rates can boost property values, creating a more attractive prospect for holding and acquiring assets. The valuation impact is nuanced, influenced by the type of asset and its location, but the underlying connection remains tied to interest rate fluctuations.

Investor behavior is equally impacted by these changes. As rates climb, more conservative approaches might take center stage, with a pivot towards asset types perceived as safer or more resilient. Amid lowering rates, appetite for riskier ventures may increase, fueled by the cheaper cost of capital and optimism for enhanced yields. This dynamic interplay means that shifts in interest rates can significantly reshape the investment landscape, pushing players to recalibrate their strategies in alignment with prevailing financial conditions.

The anticipation of rate changes also influences the market. The commercial real estate market isn't just reactive; it's highly speculative. The mere hint of rate adjustments can set off a flurry of activity, as market participants seek to position themselves advantageously. These anticipatory moves highlight the sector's sensitivity to interest rate forecasts, reflecting a collective effort to hedge against future uncertainties.

Moreover, the relative attractiveness of commercial real estate as an investment class can fluctuate with interest rate adjustments. When rates are low, the yield spread between real estate and fixed-income investments can make the former more enticing. However, as rates rise, fixed-income securities might draw capital away from real estate, reshaping the investment arena's competitive landscape.

Despite these intricacies, one constancy prevails: knowledge and adaptability remain paramount. Astute investors and developers who keenly observe interest rate indicators and adjust their strategies accordingly can not only weather potential storms but also navigate towards fruitful ventures. Understanding the nuanced relationship between interest rates and commercial real estate equips market players with the foresight needed to make calculated moves, ensuring they're ready to respond when the financial markets shift.

In summary, while interest rate fluctuations present a complex set of implications for commercial real estate, they also unveil a range of strategic possibilities. Those poised to analyze, adapt, and act in this dynamic financial landscape can leverage opportunities, mitigate risks, and chart a course towards success amidst the currents of change.

Investment Strategies

Investment Strategies on the Commercial Real Estate Board

In the evolving landscape of the commercial real estate market, shrewd investors navigate through shifting economic conditions with tact and foresight. The current climate, with its unique blend of challenges and opportunities, demands a proactive, strategic approach to investment. Understanding which strategies are thriving can provide valuable insight into the commercial real estate (CRE) domain's dynamic nature.

Diversification as a Bedrock Principle

Diversification stands out as a foundational principle for contemporary CRE investors. By spreading investments across different geographical locations and property types, investors can mitigate risks associated with specific market volatilities. For instance, while office spaces in urban centers may face headwinds due to the remote work trend, industrial properties, particularly those catering to e-commerce logistics, shine as beacons of robust demand. Balancing an investment portfolio with a mix of multifamily, industrial, and niche sectors such as data centers can create a resilient buffer against unforeseen market shifts.

Value-Add Investments

The allure of transforming underperforming properties into coveted assets fuels the value-add investment strategy. This approach involves acquiring properties that are below their potential due to various factors, such as outdated design, management inefficiencies, or subpar tenant mixes. Through calculated upgrades and repositioning, investors aim to increase these properties' value — enhancing appeal to quality tenants, driving up rental income, and ultimately elevating property valuation. Given the transformation-driven era, characterized by rapid technological advancements and changing consumer behaviors, value-add strategies offer a creative playground for investors ready to reimagine spaces in sync with modern demands.

Opportunistic Ventures

For the daring and those with a keen eye for timing, opportunistic investments offer a path less trodden but potentially more rewarding. This strategy focuses on high-risk, high-reward scenarios, from funding development projects in emerging markets to repurposing distressed assets, like converting struggling malls into logistics hubs or community spaces. The appeal lies in catching the wave of market changes early — be it demographic shifts, infrastructural developments, or emergent industry needs — thereby positioning oneself favorably as the new demand curve takes shape.

Adaptive Reuse and Sustainability

Strategies aligning with sustainability and adaptive reuse principles command increasing attention. The green wave, powered by heightened eco-consciousness among consumers and stringent regulations, propels the pivot towards energy-efficient buildings and sustainable development practices. Moreover, adaptive reuse — the art of giving old buildings new life and purpose — caters to environmental sustainability while tapping into the unique charm and structural value of historic and underutilized properties. Whether it's transforming office buildings into residential units or old warehouses into dynamic co-working spaces, these strategies resonate with the market's growing appetite for sustainability and authenticity.

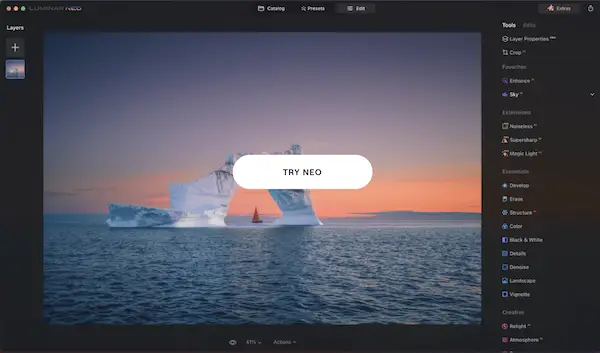

Tapping into Technology: PropTech Expansion

Investments that leverage PropTech innovations present exciting frontiers. From AI-driven property management systems to blockchain in real estate transactions, technology is reshaping the CRE landscape. Investors channeling funds into PropTech startups or adopting cutting-edge tools to enhance operational efficiency, tenant satisfaction, and decision-making accuracy are positioning themselves at the forefront of the evolving real estate market.

In essence, successful investment strategies in the current CRE market are characterized by adaptability, creativity, and a keen awareness of macroeconomic trends and innovative technologies. By blending traditional investment wisdom with nuances responding to today's economic and cultural shifts, investors can carve pathways to resilience and growth, ensuring their portfolios thrive amidst the flux of market dynamics.

Photo by nolanissac on Unsplash

Technological Impact

How Technology is Reshaping the Commercial Real Estate Industry

In an era where digital transformation touches every corner of our lives, the commercial real estate (CRE) industry finds itself at the intersection of tradition and technology. This juncture, bustling with innovation and change, is evidence of how technology profoundly reshapes the sector, influencing everything from property management and leasing operations to the very demand for office space. Let's delve into this technological pivot, unveiling the multifaceted role of technology in CRE.

The Rise of PropTech: A Paradigm Shift

At the heart of the technological revolution in CRE is PropTech—property technology. PropTech encompasses a wide array of digital tools, platforms, and applications designed to streamline and enhance the operations, management, and transactions in the real estate sector. Its ascendancy signals a paradigm shift; what once was an industry characterized by manual processes and face-to-face dealings now thrives on cloud-based platforms, big data analytics, and automation.

Digitalization in Property Management and Leasing

Digital platforms now oversee a significant chunk of leasing and asset management processes, offering unprecedented efficiencies and accuracies. From virtual property tours and automated tenant screening to electronic lease signing and online rent payments, the leasing journey has transformed into an almost entirely digital affair. For property managers, smart building technologies offer real-time insights into operational metrics from energy usage to security, allowing for proactive management and cost savings.

The wonders of IoT (Internet of Things) enable buildings to become smarter and more responsive to occupants' needs. For instance, HVAC systems can now self-adjust based on real-time occupancy data, enhancing comfort while optimizing energy consumption. Similarly, IoT-powered security systems increase building safety by identifying and reacting to threats with minimal human intervention.

Remote Work Trends: Shifting Office Space Dynamics

Perhaps nowhere is the impact of technology on CRE more pronounced than in the changing dynamics of office space demand, greatly influenced by the remote work trend. As businesses worldwide adopt remote or hybrid working models, bolstered by technological advancements, the traditional office space paradigm pivots. Instead of sprawling corporate campuses, there's an increasing appetite for flexible workspaces that support hot-desking, collaboration areas, and private meeting rooms for when face-to-face interaction becomes necessary.

This shift is not merely about reducing square footage but about reimagining office spaces as dynamic environments that promote collaboration, creativity, and well-being. Technologies such as virtual reality conferencing tools and cloud-based collaboration platforms make this transition seamless, bridging the physical distance between remote team members and fostering a cohesive corporate culture.

The Data Advantage: Informed Decision-making

Technology also arms CRE investors and professionals with a powerful asset: data. Big data analytics and AI play pivotal roles in market analysis, property valuation, and predicting trends. This wealth of information leads to more informed decision-making, helping stakeholders identify promising investment opportunities and assess risks more accurately. Furthermore, machine learning algorithms can analyze tenant behavior and preferences, offering insights that drive improvements in tenant acquisition and retention strategies.

Evolving Landscapes: A Future Fueled by Innovation

As the CRE industry navigates its tech-enabled transformation, one thing becomes clear: flexibility and innovation are key to thriving in this new landscape. As technology continues to evolve, so too will the opportunities and challenges it presents to CRE professionals. Embracing these changes, the sector stands to not only enhance operational efficiencies and service offerings but also breathe new life into properties—redefining what's possible in commercial real estate.

In sum, technology's burgeoning role in commercial real estate heralds a new era of efficiency, connectivity, and adaptability. From the individual office suite to multifaceted real estate portfolios, PropTech's influence spans the breadth of the industry, propelling it into a future ripe with potential. As CRE professionals harness these digital advancements, they equip themselves to navigate an increasingly complex market, ensuring that even amidst change, they are poised for success.

Regulatory Changes

Regulatory Ripples: Navigating the Waves of Change in Commercial Real Estate

Navigating the complex waters of commercial real estate (CRE) requires foresight, agility, and a keen understanding of the regulatory environment. Recent regulatory changes, spanning zoning laws to environmental standards, are reshaping the landscape, presenting both challenges and opportunities for stakeholders. Here's an overview of how these regulatory shifts are influencing the sector and what it means for developers, investors, and tenants.

Zoning Reforms: The Double-Edged Sword

Zoning law transformations in various jurisdictions aim to address housing shortages and promote sustainable development. Many cities are reforming their zoning regulations to allow for greater density. For developers, this presents an opportunity to embark on multifamily projects in areas previously designated for single-family residences. However, these changes could lead to an increase in land prices, raising the entry barrier for new projects. Neighborhoods resistant to change may also slow developments, complicating project timelines.

Investors need to stay ahead of these shifts, strategically positioning their portfolios to benefit from areas likely to see increased development activity. Tenants, particularly businesses needing retail or office spaces, may find opportunities in the mixed-use developments that zoning reforms are likely to create.

Building Codes: Rising to Meet Modern Standards

Building codes are also being updated, with a push towards energy efficiency and safety improvements. These changes aim to reduce the carbon footprint of new developments and ensure constructions can withstand natural disasters.

Adhering to these new building codes might increase initial project costs due to the need for advanced materials and technologies. However, these investments often pay off in the long run, leading to lower operational costs and more resilient structures.

Investors should view properties adhering to updated building codes as more attractive assets, likely to command higher rents and retain value better over time. Tenants would benefit from occupying these modernized spaces, enjoying lower utility expenses and enhanced safety features.

Environmental Regulations: Greening the Landscape

The increase in environmental regulations represents another crucial evolution in the CRE regulatory scene. Standards regarding water usage, waste management, and greenhouse gas emissions are becoming more stringent, driven by global commitments to combat climate change and promote sustainability.

For developers, incorporating sustainable practices from the ground up is now a necessity. These projects may qualify for various incentives, ranging from tax credits to expedited permitting processes, making sustainability an attractive proposition despite the initial challenges of compliance.

Investors should lean towards eco-friendly properties, not only from an ethical standpoint but also as a strategic move. Such properties are becoming increasingly coveted in the market, promising higher occupancy rates and greater appeal to environmentally conscious tenants.

Meanwhile, tenants stand to gain from these greener spaces. Lower energy costs and enhanced indoor air quality contribute to a more sustainable and healthier living and working environment.

The CRE sector is undergoing a transformative period spurred by recent regulatory changes. Zoning laws are evolving to accommodate more dynamic urban landscapes, building codes are adapting to modern standards of efficiency and safety, and environmental regulations are pushing the industry towards sustainable practices. Each of these changes brings its own set of implications for developers, investors, and tenants alike. Staying informed and adaptable will be key in navigating these changes successfully, transforming potential challenges into opportunities for growth and innovation in the ever-evolving world of commercial real estate.

Sustainability and CRE

Sustainability in Commercial Real Estate: The Green Revolution

In the realm of commercial real estate (CRE), a green revolution is quietly but steadily reshaping the landscape. As stakeholders across the globe rally towards sustainability, the emphasis on eco-friendly building practices, energy efficiency, and the burgeoning market demand for sustainable properties underscores a significant transformation. Let's delve into the impact of this sustainability surge on the CRE sector.

Green Building Practices: A Foundation for the Future

At the center of this revolution are green building practices—a beacon of innovation and ethical stewardship in construction and development. These practices transcend mere regulatory compliance, embedding sustainability into the core of property design, construction, and operation. From employing renewable materials and waste reduction techniques to integrating natural light and green spaces, green building practices are redefining what it means to construct with conscience.

Properties designed with sustainability in mind often meet and exceed burgeoning environmental standards, positioning them favorably in a market increasingly sensitive to ecological concerns. These properties attract a premium, not only in terms of tenant preference but also in asset valuation, as they're poised to stand the test of time against tightening environmental regulations.

Energy Efficiency: Cutting Costs, Conserving the Planet

Energy efficiency goes hand in hand with green building. This drive towards minimizing energy consumption manifests through advanced HVAC systems, smart lighting, and energy management technologies, among others. The appeal of energy-efficient features lies not just in their potential to reduce carbon footprints but also in their capacity to lower operational costs significantly.

- For tenants, the appeal of such features is twofold:

- They contribute to a healthier environment both internally and globally

- They promise tangible savings on utility bills

- For investors and developers, energy efficiency elevates property desirability, enhancing occupancy rates and ensuring a competitive edge in the race for sustainability.

The Rising Tide of Market Demand for Sustainable Properties

Perhaps most telling of the significance of sustainability in CRE is the shift in market demand. Consumers and businesses alike are rallying for sustainable living and working environments, voicing their preferences through leasing choices and investment dollars. This growing conscientiousness is a paradigm shift in societal values toward environmental responsibility.

Developers and investors attuned to this change are reaping rewards. Properties that embody sustainability principles are rapidly becoming the gold standard, commanding attention from a market eager to align financial investments with ecological values. This alignment not only fosters a positive public image but also ensures longevity in an industry grappling with its environmental impact.

The integration of sustainability practices promises not only to redefine commercial spaces but also to reshape our collective future, grounding our aspirations in respect for the environment. As commercial real estate continues to navigate the currents of change, sustainability stands as a guiding beacon—a testament to the sector's capacity for innovation, responsibility, and proactive adaptation in an increasingly eco-conscious world.

Photo by alesiaskaz on Unsplash

The journey through the commercial real estate landscape reveals a sector that is both resilient and adaptable. Amidst shifts in market demand, technological innovations, and regulatory adjustments, sustainability emerges as a key pillar, guiding the industry towards a future where economic viability and environmental responsibility converge.