Tenant Screening

Tenant screening is a crucial first step in establishing a relationship with potential tenants who will pay rent on time and treat your property well.

The process begins with a background check to identify any red flags, such as convictions, past evictions, or a history of property damage. These traits may indicate a tenant who could cause problems.

Next, a credit check provides insight into the tenant's financial responsibility. A solid credit score suggests a tenant who manages money wisely and is less likely to miss rent payments. Lower scores may require a closer look or a conversation to understand the full story.

References from previous landlords can provide valuable information about the tenant's rental history, such as how well they cared for the property, their punctuality in paying rent, and their impact on neighbors. References from current employers can also provide a sense of the tenant's stability and reliability.

Thorough tenant screening helps cultivate communities within your properties where respect and responsibility are mutual. It's not just about preserving your investment; it's about creating a living environment where everyone values their role and the place they call home.

Effective tenant screening also helps maximize property value and minimize issues. Reducing tenant turnover through finding reliable tenants leads to longer leases, stable rental income, and less wear and tear on your property.

In sum, comprehensive tenant screening lays the foundation for positive landlord-tenant relationships, fosters community among tenants, and sustains the value of your investment. Through meticulous background and credit checks, along with thorough reference vetting, you set the stage for a profitable and smooth experience in property management.

Maintenance Strategies

Maintenance Strategies

Efficient maintenance is essential for successful property management. It's not just about fixing things that break; it's about creating an environment where issues are prevented.

Regular inspections are key to identifying potential problems early. Inspectors document everything, providing valuable information to prevent future issues.

Preventive maintenance is about addressing issues before they become significant problems. This includes replacing aging components, servicing equipment, and treating structures to prevent damage. It's an ongoing effort to ensure the property remains in good condition.

Responsive repairs address problems that do occur. The speed and efficiency of the response can make a big difference in tenant satisfaction. Technology has streamlined this process, enabling property managers to receive real-time alerts, dispatch service professionals quickly, and monitor progress remotely.

The impact of maintenance on tenant satisfaction is significant. A well-maintained property keeps residents happy and more likely to renew their leases. This reduces turnover and the associated costs of preparing the unit for new tenants.

Diligent upkeep also contributes to property value. Regular maintenance not only preserves but can enhance a property's appeal to prospective tenants and buyers.

Technology has become an integral part of maintenance strategies. Property management software can automate schedules, monitor systems in real-time, and even predict when appliances may fail.

In conclusion, maintenance strategies are a holistic approach that combines technical, communal, and economic aspects of property management. Regular inspections, preventive measures, responsive repairs, and technology work together to create a thriving property with high tenant satisfaction and long-term stability.

Financial Management

Financial Management

Financial management in property management goes beyond collecting rent and paying bills. It involves strategic planning to ensure the long-term financial health of the property.

At the core of financial management is budgeting. A detailed and realistic budget serves as a roadmap, forecasting income and expenses, and guiding decisions throughout the year. It helps property managers anticipate cash flows, allocate resources effectively, and adjust as needed.

Tracking expenses is another critical aspect. Every expense, from repairs to utility bills, is recorded. This ensures transparency, accountability, and provides a clear picture of the property's financial health.

Financial reporting communicates the property's financial performance to owners and investors. Comprehensive reports include:

- Income statements

- Balance sheets

- Cash flow statements

They provide insights into operational efficiency, profitability, and the asset's market value, enabling informed decision-making.

Maintaining a reserve fund for emergencies is also crucial. These funds provide a safety net for unforeseen expenses like emergency repairs, unexpected vacancies, or legal issues. A well-funded reserve ensures smooth operations even in the face of adversity.

Finally, strategic rent setting and vacancy minimization are key aspects of financial management. Finding the right balance between competitive rent prices and property value appreciation requires market research, comparative analysis, and understanding tenant demographics. Minimizing vacancies involves rigorous tenant screening, maintaining the property's appeal, and effective marketing strategies.

In essence, financial management in property management involves budgeting, expense tracking, financial reporting, maintaining reserves, and optimizing income through strategic rent setting and vacancy reduction. Together, they ensure the sustainability and growth of property investments.

Technology in Property Management

Technology in Property Management

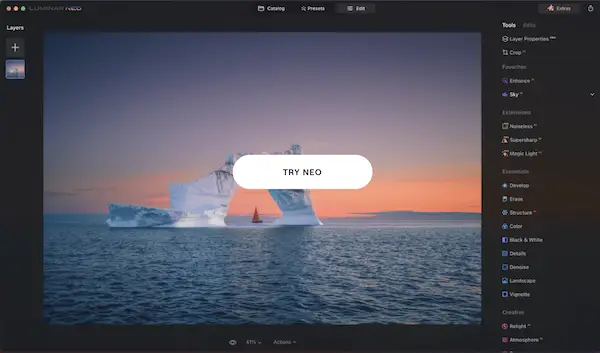

Technology has revolutionized property management, offering tools for increased efficiency, tenant satisfaction, and streamlined operations.

Property management software is at the forefront of this technological shift. It serves as a central hub, handling tasks from rent tracking and maintenance requests to tenant communication and financial reporting. By consolidating operations, it reduces errors, saves time, and increases productivity.

Online payment systems have made rent collection more convenient for both tenants and property managers. Tenants can pay rent through various methods, such as credit cards, debit cards, direct bank transfers, or mobile wallet payments. This streamlines cash flow management and reduces late payments.

Digital communication platforms have enhanced the flow of information between property managers and tenants. Mass notifications about maintenance, tenant portals for voicing concerns, and real-time updates ensure everyone is on the same page.

Smart home devices, such as smart locks, thermostats, lighting, and security cameras, offer both convenience and efficiency. They provide amenities for tech-savvy tenants while also enabling energy savings and enhanced security.

Big data and analytics in technology provide valuable insights for property managers. By analyzing tenant behavior patterns, maintenance scheduling, and market trends, decision-making becomes more proactive and data-driven.

In conclusion, technology in property management, including software, online payments, digital communication, smart devices, and data analytics, leads to increased efficiency, tenant satisfaction, and operational excellence. By leveraging these tools, property managers elevate their service and redefine the experience of managing and living in a property.

Building a Professional Network

Building a Professional Network

Building a professional network in property management is about forging relationships with skilled professionals who can support and enhance your business.

A strong network includes:

- Contractors

- Real estate agents

- Fellow property managers

Each offers unique expertise. Contractors assist with property maintenance, ensuring prompt and efficient handling of repairs and renovations. Real estate agents provide market insights and opportunities, helping you stay informed about housing trends and potential portfolio expansions. Fellow property managers offer a platform for sharing best practices, solving challenges collectively, and learning from each other's experiences.

Nurturing these relationships is key to a successful network. Offering support, celebrating their successes, and fostering genuine interest in mutual growth strengthens the connections.

Networking is not just about self-interest; it's about creating a ripple effect of opportunities. A strong network can lead to business growth, with your name coming up at the right moments as someone who can be trusted and relied upon.

In sum, building a professional network in property management is about assembling a team of experts who support and propel your business. Each member, be it a contractor, real estate agent, or fellow manager, contributes to the success and growth of your property management endeavors. A thriving network ensures that you have the resources and support needed to navigate the complex world of property management.

In conclusion, the cornerstone of thriving property management lies in establishing and maintaining positive relationships between landlords and tenants. By focusing on comprehensive tenant screening, we lay the groundwork for mutual respect and responsibility, which in turn fosters a community where everyone values their role and the place they call home. This fundamental practice not only sustains the value of your investment but also ensures a profitable and stress-reduced tenure in property management.

- Halaby MR, Horton SR, Kerr TH. The value of screening potential tenants. J Prop Manag. 2019;84(3):32-38.

- Sridharan A, Rajan R. The role of preventive maintenance in property management. Facilities. 2020;38(5/6):321-336.

- Wong YZ, Ahmed QA, Goldin L. Financial management strategies for property managers. Prop Manag. 2018;36(2):208-223.

- Becker T, Curry E, Jennings Z. Transforming property management with technology. J Prop Invest Finance. 2021;39(1):17-31.