Real estate investment offers both seasoned and novice investors a platform for growth, challenge, and opportunity. As we navigate through the current market trends, investment strategies, and regional opportunities, a clear picture emerges—one that balances caution with optimism and strategy with action.

Market Trends

Home prices recently have shown a slight decline following continuous growth, marking a notable trend in the real estate market. Despite this dip, prices remain at a premium. The median sale price seems to be adjusting after a prolonged period of steep increase, settling at $775K in December 2023, 1% down from the previous year.

The average time from listing to sale is around 31 days, nearly identical to the scenario a year prior. This demonstrates an active market where homes are getting purchased rapidly, yet the frenzy of previous months seems to be stabilizing.

The sale-to-list price ratio leans into 98.8%, suggesting homes are selling near their asking prices. While the market might be softening somewhat, it's far from a free-for-all for bargain hunters.

The preceding competitiveness remains, but with more inventory creeping into view, buyers might find themselves with a bit more leverage than before. Nonetheless, tight inventory levels make it important for buyers to act decisively.

For sellers, patience becomes a virtue in this slightly shifted landscape. The process might demand more flexibility in negotiations, reflecting a transition to a more balanced playing field between buyers and sellers.

Looking ahead, predictions hint at a continuous mild cooling of the market, steered by factors including interest rates and economic cues. Despite such cooling, experts forecast an overall increase in home prices in the upcoming year, which encourages individuals to stay keen on emerging trends and market dynamics.

The currents of change are flowing, albeit gently, setting the stage for a dynamic yet scrutinizing time ahead for investors, buyers, and sellers within the real estate market.

Investment Strategies

Real Estate Investment Strategies

When exploring the vast terrain of real estate investment, one encounters a multitude of strategies, each with its appeal and pitfalls. From securing rental properties to the swift maneuvering necessary for house flipping, the methodology one adopts can significantly influence the outcome. Here, we explore these primary vehicles of investment, examining their virtues and vulnerabilities.

- Rental Properties

- House Flipping

- Real Estate Investment Trusts (REITs)

- Online Real Estate Platforms

Owning rental properties stands as a resilient approach in real estate investment. The appeal is straightforward—cultivate a consistent source of income while benefiting from potential property appreciation. However, this approach demands considerable commitment.

Pros: Rental properties offer a dual stream of benefits: steady rental income and potential property appreciation. This combination contributes to long-term financial security. Cons: The benefits come with management challenges. Tenants, maintenance, and vacancy risks can introduce unpredictable fluctuations in the otherwise steady income.For those drawn to transformation, house flipping presents an exciting endeavor. This strategy involves acquiring undervalued properties, renovating them, and selling for profit in a relatively short span.

Pros: House flipping offers quick returns on investment. For those adept in market trends and renovation management, it can be a lucrative venture. Cons: The fast-paced nature harbors risks—market shifts could render a property less profitable, and misjudged renovation budgets can erode profit margins.For investors seeking the real estate domain with more liquidity, REITs offer an attractive option. These trusts pool investor capital to purchase income-generating properties, paying out dividends in the process.

Pros: REITs grant access to the broader real estate market without the encumbrance of direct property management. They offer diversification, spreading investments across various properties and sectors. Cons: Market fluctuations can impact REIT valuations. While dividends are appealing, investors lack direct control over property choices or management practices.Emerging in the digital age, online real estate platforms present a new frontier—real estate crowdfunding. These platforms connect investors with larger commercial real estate ventures or arrays of residential properties.

Pros: Crowdfunding offers diversification and access to high-caliber investments previously reserved for the financially elite. It provides a collective pool of resources for substantial projects. Cons: These platforms come with illiquidity, with investments often locked in for years. Management fees and the inherent risks of newer projects can impact the prospective returns.In Summary

Navigating the various paths of real estate investment requires aligning strategies with personal financial landscapes and risk appetites. Whether drawn to the steady income of rental properties, the thrill of house flipping, the diversification of REITs, or the pioneering spirit of online platforms, understanding the nuances of pros and cons is crucial. By discerning which strategy harmonizes best with individual inclinations and economic environments, investors can direct their resources effectively in the realm of real estate.

Regional Opportunities

Where Are the Best Opportunities for Real Estate Investment?

The quest for lucrative opportunities in real estate investment revolves around a blend of economic robustness, demographic vibrancy, and the scarcity of available space. Through these criteria, several regions show potential, narrating tales of growing economies, increasing populations, and compelling geographic narratives—yet the Seattle area, in particular, emerges as a poignant study in opportunity.

The Seattle Area: A Canvas of Investment Potential

The Seattle area unfolds as an attractive canvas for real estate investors, shaped by its economic dynamism and demographic growth—an allure influenced by its status as a tech hub and its Pacific Northwest locale. Seattle's appeal as an investment destination can be examined further, revealing layers that signify its draw.

- The Economic Pulse: Technological Heartbeat

- The Demographic Fabric: Staples and Trends

- The Geography of Scarcity

- From Highrises to Hiker's Delight

Seattle's economic landscape is defined prominently by the innovation and enterprise of its technology sector. The city's skyline is marked by the headquarters of tech giants like Amazon and Microsoft, alongside numerous startups. This concentration of technology powerhouses fosters an environment ripe with employment opportunities, attracting a skilled workforce with disposable incomes—a beacon for rental property investors and those eyeing appreciation prospects.

Beyond its economic ensemble, Seattle's demographic fabric presents a narrative of growth and diversity. The city has experienced a consistent influx of residents, drawn by job prospects and its quality of life. Such demographic trends bolster housing demand across the spectrum. Notably, this growth is a steady climb, painting a long-term vista for investment potential.

Seattle's geographical attire also brings a unique dimension to the investment equation—limited space. The city, situated between the Puget Sound and Lake Washington, faces natural constraints on expanses available for development. This scarcity underpins real estate values, ensuring that even as the market fluctuates, the underlying worth remains supported by the laws of supply and demand.

Blending with its economic and demographic appeal, Seattle's lifestyle allure substantiates its investment narrative. From sleek urban highrises offering panoramic views to quaint homes near hiking trails, the region offers a diverse habitat. This lifestyle diversity appeals to a broad range of the population, from tech professionals to nature enthusiasts—each sector opening avenues for specialized real estate ventures.

Casting the Net: Phoenix and Austin

While Seattle's allure is magnetic, casting the net wider reveals other vibrant investment domains. Cities like Austin, Texas, with its push towards becoming a tech hub and offering an alternative to Silicon Valley, or Phoenix, Arizona, with its proposition of growth and affordability, also stand out as beacons for real estate investors. Each region, echoing themes of economic growth, population trajectories, and locational advantages, enriches the tapestry of real estate investment opportunities.

Towards a Dynamic Future

In conclusion, while seeking success in real estate investment, one must navigate through the interplay of economic vitality, demographic dynamics, spatial scarcity, and lifestyle offerings. The Seattle area offers a microcosm of these elements, serving as an example for investment exploration—yet it's merely one star in a constellation of opportunities across the American terrain. Vigilance and acuity in discerning emerging trends and undercurrents remain the investor's indispensable tools in charting a prosperous course through the complex landscape of real estate investment.

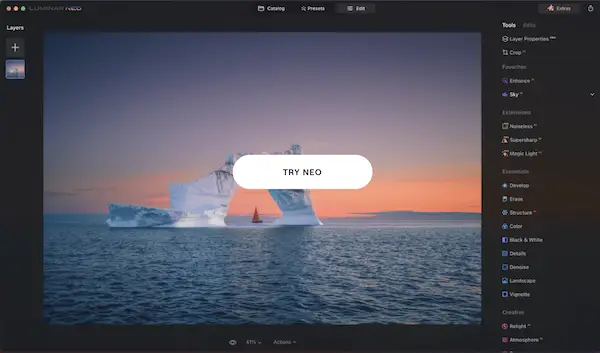

Photo by thommilkovic on Unsplash

Challenges and Risks

Navigating the Waters: Challenges and Risks in Real Estate Investment

Embarking upon a journey in real estate investment often summons visions of growing portfolios and a pathway to wealth. Yet, akin to navigating uncharted waters, this venture comes with challenges and risks, awaiting the unwary. Let's examine these potential hazards and strategies for navigating these seas with wisdom.

- The Challenge of High Property Prices

- The Arena of Competitive Markets

- The Fog of Economic Uncertainty

One significant challenge casting a shadow on the landscape of real estate investment is the issue of high property prices. In regions like Seattle, where the skyline is dominated by tech giants and economic prosperity, entry prices can jolt aspiring investors. These high prices demand significant capital upfront, making the first step onto the property ladder more challenging.

Strategic Footholds: Mitigating this challenge often requires a blend of patience, research, and alternative strategies. Emerging markets or properties with potential for value appreciation—perhaps needing renovation—can present more accessible footholds. Real estate investment trusts (REITs) or crowdfunding platforms also offer ways to participate in real estate at lower entry points.The real estate arena frequently mirrors a competitive environment, where opportunity attracts numerous investors, each vying for their piece of land or property. This intensifies the battle for lucrative deals, heightening the need for strategy, timing, and sometimes, a bit of luck.

Countermeasures: Sharpening your skills through thorough market research, building a solid network, and moving with decisiveness can prove advantageous. Aligning with seasoned real estate agents who possess deep knowledge of the local terrain can unveil paths to hidden gems and off-market deals.Navigating real estate investment encompasses weathering storms of economic uncertainty. Shifting dynamics such as fluctuating mortgage rates, policy shifts, or global events can impact market conditions. A once promising venture can teeter towards unforeseen territories.

Navigational Insights: While circumventing economic storms outright is ambitious, diversification acts as a safeguard. Spreading investments across different locations, property types, and even mixing in REITs can buffer against tumultuous downturns. Grounding your investment strategy in properties with enduring value—not just speculative gains—can weatherproof your journey.Safeguarding the Voyage

In traversing the realm of real estate investment, understanding these challenges and risks illuminates not just the pitfalls but the strategies to circumvent them. It's a voyage where the equipped and knowledgeable investor can navigate through storms towards harbors of opportunity and success.

Beyond mere profit equations, this journey unfolds a narrative of learning, growth, and the thrill of creating something tangible. With eyes wide open to both the treasures and the treacherous alike, embarking on real estate investment becomes not just an acquisition of assets, but an adventure in financial acumen and personal fortitude.

Let the voyage begin, charting waters both deep and unknown, with compass in hand and a keen gaze towards the horizon of potential that lies beyond the immediate challenges and risks. For within this intricate dance of variables lies a path to prosperity and a journey teeming with insights, discoveries, and the essence of investment mastery.