Sales Comparison Approach

The Sales Comparison Approach is a primary method for determining the fair market value of a property. Appraisers find comparable properties that have sold recently in the same neighborhood with similar characteristics such as size and features.

Adjustments are made for differences between the properties, such as an extra bathroom or recent renovation. The appraiser assigns a dollar value to these differences to ensure an equitable comparison. For example, if two nearly identical houses are found but one has a deck, the appraiser would subtract the value of the deck from that property's sale price to estimate the value of the house without a deck.

Appraisers prioritize recent sales, typically within the past six months, as they provide the most current and relevant data on market conditions and buyer preferences. Older sales data may not accurately reflect the current market, especially in rapidly changing areas.

Cost Approach Valuation

The Cost Approach Valuation is a crucial yet complex method used primarily for new or unique properties. The process begins with estimating the value of the land as if it were vacant. This provides a baseline for the property's potential worth.

Next, the appraiser considers the construction costs, including materials, labor, and architectural design. The goal is to calculate the expense of building or rebuilding the structure from the ground up.

Depreciation is then factored in to account for any wear and tear or obsolescence of the property. The appraiser distinguishes between curable and incurable depreciation, quantifying the impact on the overall value.

Finally, the land value and construction costs are combined, minus depreciation, to arrive at the property's worth. The Cost Approach is particularly useful for valuing special-purpose buildings or new constructions that may not have comparable sales data available.

Income Capitalization Method

The Income Capitalization Method is used for properties that generate revenue, such as rental properties or commercial buildings. This approach focuses on estimating the potential income a property can produce.

The appraiser begins by determining the property's potential gross income, assuming it is fully occupied and rented at market rates. Next, vacancy losses are factored in, acknowledging that properties may experience periods of vacancy between tenants.

Operating expenses such as maintenance, taxes, and utilities are then deducted from the gross income to calculate the net operating income (NOI). This represents the actual income an owner can expect to receive from the property.

Finally, the NOI is converted into an estimate of the property's market value using the capitalization rate (cap rate). The cap rate is derived from comparable properties with similar income streams and reflects the relationship between the NOI and the property's value.

Integrating Technology in Appraisals

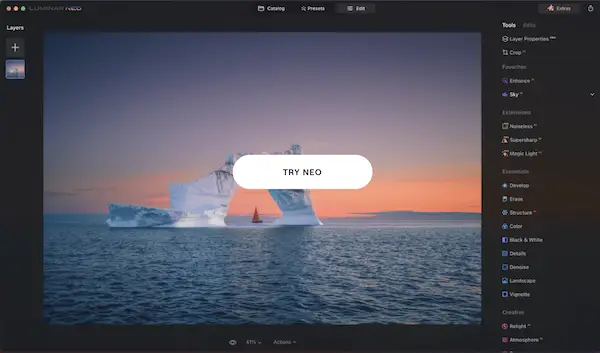

Technology is transforming the field of real estate valuation, offering new tools and techniques for enhanced accuracy and efficiency. Machine learning algorithms can analyze vast amounts of data, including sale prices, market trends, and property characteristics, to predict property values with remarkable precision.

Fuzzy logic is another approach that allows for more nuanced assessments. Rather than relying on binary "yes" or "no" evaluations, fuzzy logic considers the shades of gray that often characterize real-world scenarios. This enables appraisers to weigh various factors and subtleties that might be overlooked by more rigid methods.

Aerial data analysis, utilizing drones and satellites, provides a comprehensive view of a property and its surroundings. This bird's-eye perspective reveals details that may not be apparent from the ground, such as the property's proximity to amenities or potential development encroachment.

The integration of machine learning, fuzzy logic, and aerial data analysis creates a powerful toolkit for appraisers. These technologies enhance precision, speed, and the ability to navigate complex market conditions, ultimately leading to more accurate and reliable property valuations.

Challenges in Real Estate Valuation

Real estate valuation faces several challenges that can complicate the appraisal process. Market volatility is one such challenge, as property values can fluctuate rapidly in response to economic conditions or local market dynamics. Appraisers must strive to provide an accurate assessment based on current data while acknowledging the potential for short-term changes.

Data availability is another obstacle, particularly in small towns or niche markets where sales transactions may be infrequent. In these cases, appraisers must rely on their expertise and derive insights from limited information to arrive at a reasonable valuation.

Subjective appraisal methodologies, which attempt to quantify intangible aspects such as a property's charm or ambiance, also pose a challenge. While these factors undoubtedly influence a property's appeal and value, they are difficult to measure objectively. Appraisers must strike a balance between empirical data and their professional judgment when considering such qualitative elements.

To overcome these challenges, appraisers employ a range of strategies. They leverage technology to analyze market trends, bridge data gaps with carefully selected proxies, and develop systematic approaches for assessing qualitative factors. By combining rigorous analysis with informed intuition, appraisers navigate the complexities of real estate valuation to provide reliable and defensible assessments.

At the journey's end, it becomes clear that the art and science of real estate valuation are grounded in a balanced understanding of various methodologies. Among these, the Sales Comparison Approach shines as a fundamental tool, providing a reliable basis for comparison and adjustment that resonates with both the logic and nuances of market dynamics. This method, with its focus on recent sales and comparable properties, remains a cornerstone in the quest to uncover the true value of real estate.

- Pagourtzi E, Assimakopoulos V, Hatzichristos T, French N. Real estate appraisal: a review of valuation methods. J Prop Invest Finance. 2003;21(4):383-401.

- Adetiloye KA, Eke PO. A review of real estate valuation and optimal pricing techniques. Asian Econ Financ Rev. 2014;4(12):1878-1893.

- Abidoye RB, Chan APC. Artificial intelligence in property valuation: application framework and research trend. Prop Manag. 2018;36(5):597-615.